The decentralised Wild West of crypto

When you watch hours of people trying to describe “tokenisation” in 12 different ways, you start to question the “clarity” claim in the marketing materials

I once had a reporter ask me what the difference was between central bank digital currencies and stablecoins. “Good question,” I remember saying. “Well, CBDCs are digital versions of fiat currencies, while stablecoins are digital tokens whose value is tied to a real-world asset, which is usually a fiat currency.”

“O…..k”, she said. “So, ummm…what’s the difference then?”

I should have explained it better. Her confusion, and it is a legitimate one, doesn’t lie in the technology or structure of the “coins” but in the culture and market response to each flavour of digital currencies on offer.

Most of us with an even passing interest in all things decentralised finance know that those who view tokens, coins, and smart contracts as the desired future for the global financial system hate CBDCs. If you have no experience with this world, you might ask yourself, why? Why the hatred for a digital currency that is equal to a fiat currency in the physical world, while a coin made stable by linking to that same fiat currency launches a thousand fawning LinkedIn posts, full of “takeaways”, emoji tabbed bullet points, and a generous supply of “em” dashes.

I spent the past couple of months watching and covering the recent series of roundtables put on by the US Securities and Exchange Commission, which was dubbed “A sprint towards crypto clarity”. When you watch hours of people trying to describe “tokenisation” in 12 different ways, you start to question the “clarity” claim in the marketing materials.

There was considerable discussion during the US roundtables about the attitude of the previous administration towards the growth of cryptocurrencies, blockchain, and DeFi networks. The former chair of the US SEC could be described as hostile to the community. However, as I have written before, this friendlier regulatory environment in the US for all things coins and crypto has come at a price, I think more people should take into account.

Ultimately, the arguments about the exact structure and issuer of digital assets are unrelated to technology, design, or ease of use. The issues lie in expectations of control, oversight, and transparency.

Let me offer a better answer to my former reporter’s question about the differences between CBDCs and stablecoins. Suppose I ask you to do a job for me, such as mowing my front lawn or walking my dog. I agree to pay you $50 to do this. One way to pay you would be to deposit $50 worth of cash in your bank account (a CBDC, if you like). A second option would be to provide you with a $50 Amazon voucher (a stablecoin).

Now, ask yourself a question: Which “payment” would you list as income on your end-of-year tax return?

Both are worth $50. Both were received as payment for a job. Honestly, which payment would be listed as “income”? Now, technically, both are considered income and should be declared to a central tax authority – but in practice, law-abiding citizens will typically declare the cash and view the voucher as a “gift.”

That is the issue and the root cause of the hysterical hatred of “centralised” authorities, especially ones connected to governments, when it comes to money. Don’t believe anyone who claims the crypto craze is a response to the 2008 banking crisis (half these people were in primary school when that happened). Those who preach the gospel of “being your own bank” and “decentralised trust” are concerned not with the stability of a global monetary system, but with government insight into income for tax purposes.

Yep, I said (or wrote) that out loud.

Let me double down.

Decentralised propaganda is promoted by rich people who want to expand and scale obvious Ponzi-type schemes like meme coins, which promise wealth creation for all, but in reality only line the pockets of the few. For “the few,” they are looking to shield that income from any tax-collecting authorities.

A central bank issuing a digital currency, a CBDC, would make collecting taxes and finding cheats much easier for central governments. That is why a “digital coin of a fiat currency” is so hated, while a “digital token tied to a fiat currency” is embraced. Stablecoins are easier to hide.

(Don’t write in about all the technical infrastructure benefits of stablecoins, tokenisation, and the like. Additionally, I know the future lies in stablecoins issued by commercial banks. I know that, and agree, but this post is about vibes, not trends.)

The 2025 Crypto Crime Report from TRM Labs found that stablecoins, especially USDT from Tether, are the preferred currency choice of groups such as ISIS-K, Hamas, and Hezbollah. (These people aren’t looking for a central bank to oversee currency flows, either.)

Recently, I was speaking to someone embedded in the crypto space who wasn’t interested in being quoted because, as he put it, “the crypto bros” don’t really like his view of the current landscape. Fair enough, but I wanted to share it because it aligns with many of my own views.

We are in the Wild West.

Now, I grew up with a father who fantasised about the Wild West. He consumed John Wayne movies with relish, and when I was 12 years old, he bundled the family into a station wagon and drove from Boston to Wyoming so we could attend a rodeo (it took like three weeks to get there, I am an expert on mid-1980s, cheap, roadside American motels).

I get it, the lore is intoxicating. There is a certain, rugged American vibe to the idea of “the Wild West” and all its Wyatt Earp, shootout at the OK Corral mythology. But to quote another well-known “Wild West” movie: “When the legend becomes fact, print the legend.”

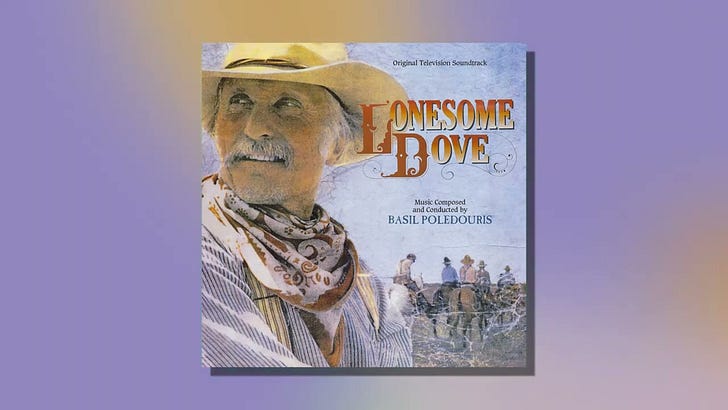

The legend is what is seductive. The reality of the American frontier in the latter half of the 19th Century is much darker, dirtier, and more complex than watching a 1940s actress with perfectly styled hair and impossibly perfect lipstick mooning over a brooding cowboy in a black-and-white film would lead you to believe. (Read the novel Lonesome Dove by Larry McMurtry for a better western tale.)

Here’s the take from my contact:

“We use the technology for good. We use these assets, and I think the technology is brilliant. But …it's a bit wild west, in the sense of if your stagecoach gets hijacked, if you break a leg, you're not getting keyhole surgery or some sort of advanced treatment.”

Much like the Gilded Age, which coincided with the Wild West, the economic reality embraced by decentralisation “is brutal”, he continues. A class of the ultra-wealthy will emerge, much like the Rockefellers, who will build infrastructure and pass their wealth on through generational transfers. At the same time, an underclass reminiscent of the Victorian era will expand.

The issue is that the decentralised world lacks a “compliance layer”, says my contact, where value can be accessed without barriers. If someone gains access to the keys of a crypto wallet, it is equivalent to giving them the keys to your house and providing the passcode to the family safe. With traditional finance, there is usually a third-party bank with compliance requirements and controls in place.

If we are entering an era where bitcoin holdings are being touted as proof of collateral for mortgages, what happens when, or if, there is a collapse in the price of Bitcoin, and there’s a tranche of mortgages pinned to those values? Don’t cite the 2008 banking crisis if you don’t understand what happened.

As Mark Twain said: History doesn’t repeat itself, but it does rhyme. Let’s hope it doesn’t rhyme too much.

***

Although the book is awesome, I recommend it to everyone (trust me, even if you think you hate westerns). However, they also created a mini-series (or limited series) of the book around 20 years ago. The soundtrack is exactly what you’d expect.